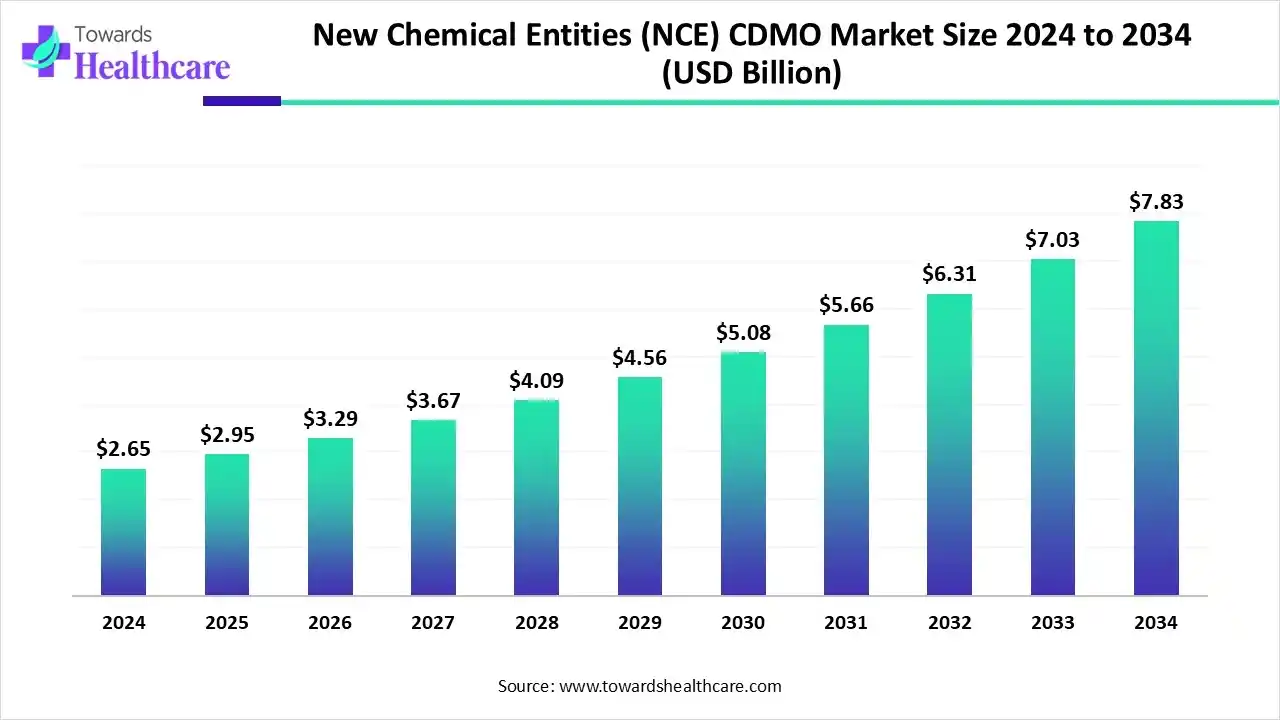

New Chemical Entities CDMO Market Towards USD 7.83 Billion by 2034

The global new chemical entities (NCE) CDMO market size is calculated at USD 2.95 billion in 2025 and is expected to reach around USD 7.83 billion by 2034, growing at a CAGR of 11.44% for the forecasted period.

Ottawa, Nov. 24, 2025 (GLOBE NEWSWIRE) -- The global new chemical entities (NCE) CDMO market size was valued at USD 2.65 billion in 2024 and is predicted to hit around USD 7.83 billion by 2034, rising at a 11.44% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is because pharmaceutical and biotechnology firms are increasingly outsourcing the development and manufacturing of novel compounds to specialised contract development and manufacturing organisations (CDMOs) so as to accelerate time-to-market, manage complexity and reduce capital investment.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6292

Key Takeaways:

- New chemical entities (NCE) CDMO sector pushed the market to USD 2.65 billion by 2024.

- Long-term projections show USD 7.83 billion valuation by 2034.

- Growth is expected at a steady CAGR of 11.44% in between 2025 to 2034.

- By region, North America was dominant in the new chemical entities (NCE) CDMO market in 2024.

- By region, Asia Pacific is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By service type, the process development and optimization segment was dominant in 2024.

- By service type, the analytical and regulatory support segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By compound type, the small molecules/NCEs segment was dominant in 2024.

- By compound type, the specialty & complex NCEs segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By end user, the pharmaceutical companies segment was dominant in 2024.

- By end user, the biotechnology companies segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

Market Overview:

What factors are affecting demand in the market for NCE CDMOs?

The global NCE CDMO market is becoming much more dynamic, as drug-developers are choosing to partner externally to manage the development, scale-up and commercialisation of new chemical entities. Growth is driven by the increasing number of NCE programmes, the increasing complexity of these molecules, the need for more specialised manufacturing and the desire to outsource to managed partners across the pharmaceutical value chain.

Quick Facts Table

| Table | Scope | |

| Market Size in 2025 | USD 2.95 Billion | |

| Projected Market Size in 2034 | USD 7.83 Billion | |

| CAGR (2025 - 2034) | 11.44 | % |

| Leading Region | North America | |

| Market Segmentation | By Service Type, By Compound Type, By End-User / Client Type, By Region | |

| Top Key Players | Cambrex Corporation, Boehringer Ingelheim BioXcellence, PCI Pharma Services, Evonik Industries AG, AMRI (Albany Molecular Research Inc.), Fujifilm Diosynth Biotechnologies, Siegfried Holding AG, Aenova Group, Vetter Pharma International GmbH, Avara Pharma Services | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What are the major factors driving growth of the New Chemical Entities (NCE) CDMO market?

- Increased pipeline of novel drugs and outsourcing needs: The pharmaceutical industry is increasingly developing new chemical entities to address unmet medical needs, especially in oncology, rare diseases and immunology, and many lack internal manufacturing capacity or capability, thus outsourcing to CDMOs.

- Complexity of molecules and demand for specialty services: The shift from traditional small molecules to highly potent chiral, supplementally low solubility or complex compounds means drug developers need CDMOs with high-order capabilities in process development, scale-up, analytics, and regulatory support.

- Cost and time pressures that drive strategic outsourcing: There is an increasing level of pressure to minimize drug development time and costs, as well as regulatory measures (fast-track, accelerated) that utilize outsourcing to CDMOs to help reduce risks and focus on core R&D and faster launches.

- Geopolitical, supply chain and regulatory forces impacting CDMO growth: Disruptions in the supply chain, reshoring in constrained markets, increasing regulatory scrutiny, and the need for a global manufacturing footprint, are all prompting companies to engage CDMOs that can provide compliant, scalable and flexible manufacturing services.

Key Drifts:

What Factors are Impacting the NCE CDMO market?

Key trends impacting the market include a higher adoption rate of continuous manufacturing and flow chemistry systems for CDMOs to facilitate better handling of novel molecules, more incorporation of AI and digital tools into process development and analytics, and an increasing number of collaborations between CDMOs and biotech companies to manage specialty and complex NCEs. In addition, CDMOs are expanding capacity and geographic footprint especially in Asia-Pacific, to meet increased market demand and global regulatory expectations.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

One of the primary challenges impacting the NCE CDMO market is balancing compliance requirements a result of harmonized regulations across jurisdictions and regions while maintaining the same level of high-quality manufacturing standards. As CDMOs create a global presence and handle an increased number of complex molecules, the associated costs and operational implications, associated with insuring traceability, compliance (e.g., GMP, HPAPI containment), audit readiness and supply-chain transparency can increase dramatically. This challenge can create bottlenecks in scaling or can slow product development or both.

Regional Analysis:

North America accounts for the largest share of the NCE CDMO market, driven by its established pharmaceutical and biotechnology ecosystem, higher R&D expenditures, established regulatory environment and demand for outsourced development and manufacturing services. Many small and mid-size firms in the U.S. are now increasingly looking to CDMOs to commercialize new chemical entities while CDMOs in the region are expanding their breadth of services and capacity to meet this demand. North America continues to dominate due to the proximity to clinical trials infrastructure, regulatory agencies and higher prices for innovative treatments.

Asia-Pacific is rapidly emerging as the fastest growing market for NCE CDMO services, resulting from multiple factors such as a large and growing pharmaceutical outsourcing ecosystem in addition to lower manufacturing cost bases, increased regulatory harmonization, and rapidly growing manufacturing capacity in regions such as China and India. Governments in the region are facilitating pharmaceutical manufacturing, and CDMOs are developing facilities, capabilities, and transitioning into higher value-added service areas (e.g., HPAPI, process development) to meet demand globally. The rapidly aging population, rising prevalence of chronic and rare diseases, and growing investment in drug discovery in the region are also contributing to growing demand for NCE manufacturing and development support.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By Service Type:

The process development and optimisation service type was the largest type in 2024 for NCE CDMO services. During the initial and often most intense phase of manufacturing an NCE product, the manufacture of the substance requires cost-effective and valid synthetic routes to provide acceptable yields, to verify that the benefits of the substance justify its impurity profile, and to validate the commercial viability of the process of manufacturing in sufficient scale all of which can be accomplished through the CDMO's set of capabilities to drug developers who desire outsourcing of the creation of the substance making processes as opposed to creating them in-house.

From 2025 through 2034, the analytical and regulatory support service type is expected to show the fastest growth among service types. As the NCEs become more complicated, increasing regulatory scrutiny and global marketing require extensive analytical testing and stability studies, regulatory filing and compliance work, and CDMO companies that provide these value-added as-a-service support services will command greater sharing of outsourcing related authorized spending.

By Compound Type:

The small molecules/NCEs segment maintained its lead in the compound-type category in 2024, because NCEs, and small-molecule NCEs in particular, will be the backbone of the pharmaceutical pipeline in 2024. Additionally, small-molecule NCEs are more familiar from the manufacturing perspective, making them the natural choice for CDMO (Contract Development Manufacturing Organization) R&D and manufacturing outsourcing.

The specialty & complex NCEs segment (e.g. HPAPIs, chiral compounds, highly potent APIs or novel modalities) will lead during the upcoming segment of 2025-2034 period. As therapeutic focus shifts towards orphan, precision, and highly targeted chemical entities, outsourcing demand for manufacturing and development of these more complex specialty compounds will increase.

By End-user:

In 2024, the end-user segment (pharmaceutical companies) for NCE CDMO services is anticipated to be dominated by pharmaceutical companies (established drug developers). These pharmaceutical companies have the capacity to outsource large development programmes of drug products and enter into "volume" CDMO arrangements for the development and manufacturing of novel molecules.

Over the time period being forecast, biotechnology companies are forecast to be the fastest-growing segment of end-users. In-house manufacturing of drug products tends to be smaller for biotechnology companies, which drives increased reliance on innovation outsourcing strategies. Biotech companies seem to be increasingly contracting CDMOs to allow for rapid acting on the development of new chemical entities.

Browse More Insights of Towards Healthcare:

The CDMO Aseptic Filling Solutions Market is witnessing strong momentum and is expected to maintain accelerated growth throughout the forecast period, driven by rising demand for sterile manufacturing capabilities and the expanding pipeline of specialized injectable therapies.

The pharma and biotech CDMO services market is also experiencing substantial expansion from 2024 to 2034, fueled by increasing outsourcing activities across the pharmaceutical and biotechnology sectors.

The active pharmaceutical ingredients (API) CDMO market was valued at USD 127.45 billion in 2024, increased to USD 136.92 billion in 2025, and is forecast to reach USD 260.98 billion by 2034, growing at a CAGR of 7.43% during 2025–2034.

The global AAV vector CDMO services market is expanding rapidly, rising from USD 1.24 billion in 2024 to USD 1.43 billion in 2025, and projected to achieve USD 5.14 billion by 2034, at an impressive CAGR of 15.24% between 2025 and 2034.

The small molecule CDMO market stood at USD 72.81 billion in 2024, increased to USD 78.01 billion in 2025, and is expected to climb to USD 145.12 billion by 2034, registering a CAGR of 7.14% during the forecast period.

The U.S. pharmaceutical CDMO market is expanding steadily rising from USD 36.77 billion in 2024 to USD 39.14 billion in 2025, and projected to reach USD 68.57 billion by 2034, growing at a CAGR of 6.43% from 2025 to 2034.

The global biotechnology CMO and CDMO market is seeing accelerated growth, increasing from USD 67.25 billion in 2024 to USD 74.01 billion in 2025, with expectations to reach USD 199.67 billion by 2034, supported by a robust CAGR of 11.54%.

The medical device CMO and CDMO market is also on a strong upward trajectory, with revenues expected to rise significantly and potentially reach several hundred million dollars by 2034.

The Europe pharmaceutical CDMO market grew from USD 35.48 billion in 2024 to USD 37.98 billion in 2025, and is projected to hit USD 70.05 billion by 2034, expanding at a CAGR of 7.04% over the forecast period.

The oncolytic virus CDMO services market is witnessing notable growth, with revenues anticipated to reach several hundred million dollars by the end of the 2025–2034 forecast window.

Recent Developments:

June 1 2025, Merger of Cohance Lifesciences Limited and Suven Pharmaceuticals Limited: The two companies announced a strategic merger to form a combined CDMO platform, bringing together Suven’s scale and commercial capabilities with Cohance’s expertise in ADCs, oligonucleotides and complex chemistry.

New Chemical Entities (NCE) CDMO Market Key Players List:

- Cambrex Corporation

- Boehringer Ingelheim BioXcellence

- PCI Pharma Services

- Evonik Industries AG

- AMRI (Albany Molecular Research Inc.)

- Fujifilm Diosynth Biotechnologies

- Siegfried Holding AG

- Aenova Group

- Vetter Pharma International GmbH

- Avara Pharma Services

Segments Covered in the Report

By Service Type

- Process Development & Optimization

- Analytical & Regulatory Support

- API & Intermediates Manufacturing

- Formulation Development & Manufacturing

- Clinical Trial Material Manufacturing

- Commercial-Scale Manufacturing

By Compound Type

- Small Molecules/NCEs

- Speciality & Complex NCEs

- High-Potency Compounds (HPAPIs)

- Novel Therapeutic Modalities

By End-User / Client Type

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutions

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6292

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.