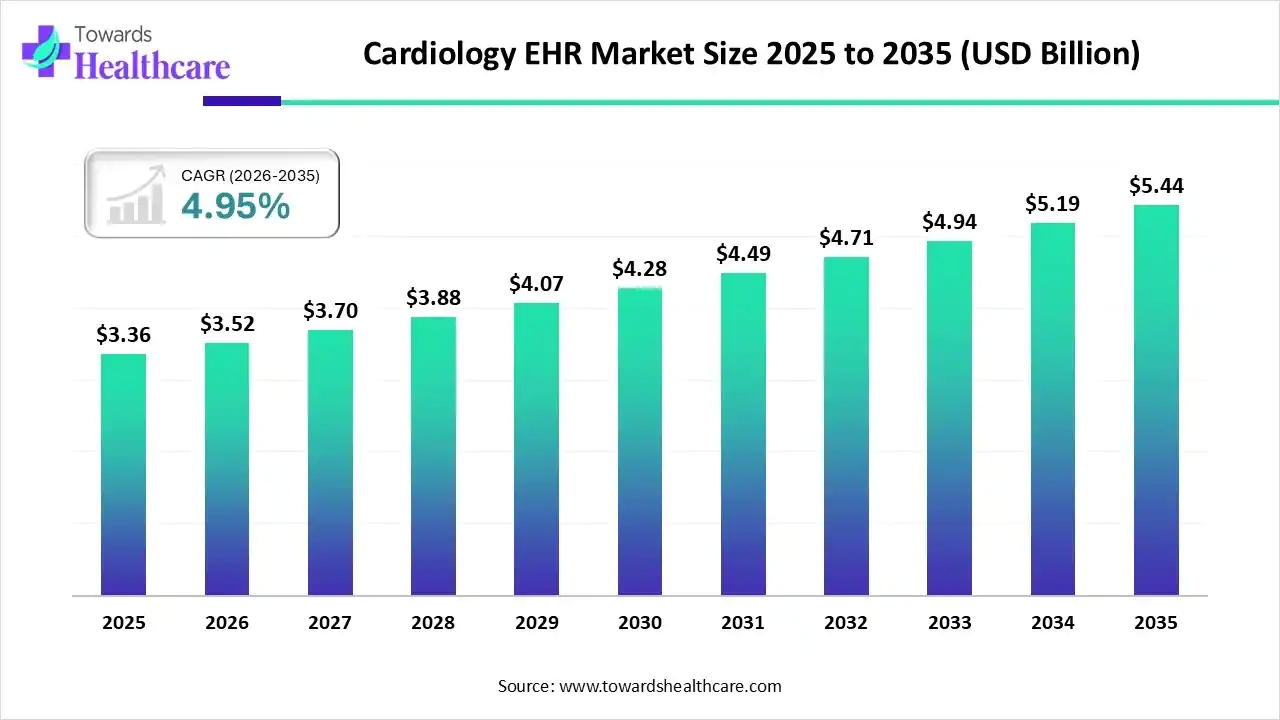

Cardiology EHR: The Digital Pulse Behind a USD 5.44 Billion Cardiac Care Evolution by 2035

The global cardiology EHR market size was valued at USD 3.36 billion in 2025 and is predicted to hit around USD 5.44 billion by 2035, rising at a 4.95% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 20, 2026 (GLOBE NEWSWIRE) -- The global cardiology EHR market size is calculated at USD 3.52 billion in 2026 and is expected to reach around USD 5.44 billion by 2035, growing at a CAGR of 4.95% for the forecasted period.

Access a personalized sample designed to support strategic planning | Download Now @ https://www.towardshealthcare.com/download-sample/6490

Key Takeaways

- North America accounted for the largest share of the cardiology EHR market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By product, the web/cloud-based EHR segment registered dominance in the market in 2025.

- By product, the on-premise EHR segment is expected to grow at a notable rate in the market during the forecast period.

- By business models, the professional services segment led the market in 2025.

- By business models, the subscriptions segment is expected to grow at a significant rate in the market during the forecast period.

- By end use, the hospital segment accounted for a considerable revenue share in the market in 2025.

- By end use, the ambulatory surgery centers segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Cardiology EHR?

Cardiology EHR is a specialized electronic health record system designed to capture, manage, and analyze cardiovascular patient data such as imaging, test results, procedures, and clinical notes to support efficient cardiac care and decision-making. The cardiology EHR market is growing due to the rising prevalence of cardiovascular diseases and increasing demand for efficient management of complex cardiac data. Growing adoption of digital health records, integration of imaging and diagnostic results, and the need for streamlined clinical workflows are driving uptake. Additionally, regulatory support for electronic records, emphasis on data interoperability, and focus on patient outcomes are accelerating market expansion.

What are the Prominent Drivers in the Cardiology EHR Market?

Prominent drivers of the cardiology EHR market include the increasing burden of cardiovascular diseases and the need to manage large volumes of complex patient data. Rising adoption of digital health solutions, demand for integrated imaging and diagnostic workflows, and emphasis on care coordination are key factors. Additionally, regulatory mandates for electronic records, growing focus on data interoperability, and efforts to improve clinical efficiency and patient outcomes continue to propel market growth.

We’re happy to help with your order or any questions; connect with us at sales@towardshealthcare.com

What are the Substantial Trends in the Cardiology EHR Market?

- In November 2025, OMRON Healthcare made a follow-on investment in Tricog Health to strengthen technology-driven cardiac care in India. The funding supports the expansion of advanced heart diagnostic solutions aimed at improving early detection and clinical decision-making across healthcare settings.

- In October 2025, HeartX, supported by HealthTech Arkansas and MedAxiom, selected seven early-stage healthcare startups for its 2025 accelerator cohort. The program focuses on advancing cardiovascular innovation by enabling real-world hospital pilot projects and clinical trials, helping promising companies validate and commercialize new cardiac care solutions efficiently.

What is the Emerging Challenge in the Cardiology EHR Market?

An emerging challenge in the market is managing complex, data-intensive cardiac information while ensuring seamless interoperability across systems. Cardiology practices handle large imaging files, device data, and real-time monitoring outputs, which can strain EHR performance. Additionally, concerns around data security, regulatory compliance, and clinician burnout due to documentation burden are increasing. Limited customization for specialty workflows and integration issues with legacy hospital systems further compliance adoption and scalability.

Cardiology and Cardiovascular Health – UK, 2023-2025

| Metric | Value |

| People living with CVD | 7.6 million+ |

| Annual CVD deaths | 174,693 |

| Daily CVD deaths | 480/day |

| Under-75 CVD deaths | 48,697 |

| Estimated adults with high blood pressure | 16 million |

| Diagnosed with high blood pressure | 11 million |

| Undiagnosed/poorly controlled high BP | 8 million |

| Economic cost of CVD | £30 billion/year |

Regional Analysis

What Made North America Dominant in the Cardiology EHR Market in 2025?

North America dominated the market in 2025 due to advanced healthcare IT infrastructure, high adoption of electronic health records, and strong emphasis on digital cardiology workflows. The presence of leading EHR vendors, widespread use of cardiac imaging and monitoring technologies, and the high prevalence of cardiovascular diseases supported demand. Additionally, favorable regulatory frameworks, interoperability initiatives, and significant investments in health IT innovation strengthened North America’s market leadership.

For Instance,

-

In July 2025, PhaseV introduced its ClinOps platform to transform clinical trial operations. The solution focuses on smarter site selection and continuous performance tracking, helping sponsors optimize trial execution through data-driven insights and more efficient operational oversight.

In the U.S., the cardiology EHR market is expanding as hospitals and specialty cardiac centers modernize digital patient record systems to improve care coordination and clinical decision-making. Strong healthcare IT ecosystems, supportive policies, and rising cardiovascular disease demand fuel the adoption of advanced EHR solutions tailored for cardiology workflows.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2025?

Asia Pacific is expected to expand at the fastest pace in 2025, driven by rapid digital health adoption, growing healthcare investments, and a rising burden of chronic diseases. Expanding hospital networks, increasing use of advanced health IT solutions, and improving regulatory support accelerated market uptake. Additionally, a large patient population, cost-effective technology development, and strong government initiatives promoting healthcare modernization further fueled rapid regional growth.

In China, growth is supported by healthcare modernization initiatives and increasing investment in digital systems that integrate patient data across cardiology departments. Rapid urbanization, expanded hospital capacity, and rising awareness among providers are encouraging cardiology EHR implementation alongside broader health IT improvements.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By Product Insights

How did the Web/Cloud-based EHR Segment Dominate the Cardiology EHR Market in 2025?

The web/cloud-based EHR segment dominated the market in 2025 due to its scalability, remote accessibility, and lower infrastructure costs. These platforms enabled seamless integration of imaging, diagnostics, and patient data while supporting real-time updates and interoperability. Growing preference for subscription-based models, easier system upgrades, enhanced data security, and support for telecardiology workflows further strengthened adoption across hospitals and cardiology practices.

The on-premise EHR segment is expected to grow at a notable rate during the forecast period due to rising demand for greater data control, security, and customization among large hospitals and speciality cardiology centers. These systems support complex workflows, local data storage, and integration with legacy infrastructure. Increasing concerns around data privacy, regulatory compliance, and limited cloud adoption in certain regions are further driving preference for on-premise solutions.

By Business Models Insights

Why the Professional Services Segment Dominated the Cardiology EHR Market?

The professional services segment dominated the market due to the complexity of cardiology workflows and the need for specialized implementation, customization, and integration support. Healthcare providers relied heavily on consulting, training, data migration, and systems optimization services to ensure smooth deployment. Ongoing regulatory compliance, interoperability requirements, and demand for workflow optimization further strengthened the dominance of professional services in the cardiology EHR market.

The subscriptions segment is expected to grow at a significant rate during the forecast period due to increasing preference for predictable costs and flexible payment structures. Subscription-based models lower upfront investment, enable regular software updates, and provide scalable access to advanced features. Growing adoption of cloud-based EHR platforms, demand for continuous support, and easier upgrades without major infrastructure changes are further accelerating subscription-based adoption across cardiology practices.

By End Use Insights

How did the Hospital Segment Dominate the Cardiology EHR Market in 2024?

The hospital segment accounted for a considerable revenue share in 2025 due to high patient volumes and the need to manage complex cardiology workflows. Hospitals require comprehensive EHR systems to integrate imaging, diagnostics, and monitoring data across departments. Strong investments in digital infrastructure, adoption of advanced cardiac technologies, and demand for interoperability and regulatory compliance further supported higher spending and revenue contribution from hospitals.

The ambulatory surgery centers segment is expected to grow at the fastest CAGR during the forecast period due to rising demand for cost-effective, outpatient cardiac procedures. These centers require streamlined EHR solutions to support faster patient throughput, scheduling, and documentation. Increasing shift of minimally invasive cardiology procedures to outpatient settings, combined with lower operational costs, growing patient preference, and improved reimbursement support, is accelerating EHR adoption across ambulatory surgery centers.

Grow your business with our research expertise - https://www.towardshealthcare.com/schedule-meeting

What are the Recent Developments in the Cardiology EHR Market

- In November 2025, Philips received 510(k) clearance from the U.S. Food and Drug Administration for the latest version of its Cardiovascular Workspace platform. The approval enhances Philips’ capabilities in cardiovascular imaging and clinical information management, supporting more efficient data integration and cardiac care workflows.

- In July 2025, iRhythm Technologies formed a strategic collaboration with Lucem Health to strengthen early identification of previously undiagnosed arrhythmias. The partnership focuses on using data-driven insights to proactively identify high-risk patient groups and support earlier clinical intervention.

Key Players List

- Epic Systems Corporation

- Oracle

- Veradigm LLC

- GE HealthCare.

- Philips Healthcare

- McKesson Corporation

- eClinicalWorks

- NextGen Healthcare, Inc.

- athenahealth, Inc.

- Greenway Health, LLC

Browse More Insights of Towards Healthcare:

The global cardiac CT market size was estimated at USD 9.03 billion in 2025 and is predicted to increase from USD 9.69 billion in 2026 to approximately USD 18.28 billion by 2035, expanding at a CAGR of 7.3% from 2026 to 2035.

The global cardiac ablation market size is calculated at US$ 5.15 billion in 2024, grew to US$ 5.88 billion in 2025, and is projected to reach around US$ 19.44 billion by 2034. The market is expanding at a CAGR of 14.24% between 2025 and 2034.

The global cardiac biomarkers market size is calculated at USD 21.27 billion in 2024, grew to USD 24.39 billion in 2025, and is projected to reach around USD 83.54 billion by 2034. The market is expanding at a CAGR of 14.66% between 2024 and 2034.

The global cardiotoxicity screening market size was estimated at USD 3.21 billion in 2025 and is predicted to increase from USD 3.59 billion in 2026 to approximately USD 9.61 billion by 2035, expanding at a CAGR of 11.58% from 2026 to 2035.

The global cardiometabolic diseases market size was estimated at USD 235.99 billion in 2025 and is predicted to increase from USD 292.04 billion in 2026 to approximately USD 1987.69 billion by 2035, expanding at a CAGR of 23.75% from 2026 to 2035.

The global cardiovascular drugs market size is calculated at US$ 150.02 billion in 2024, grew to US$155.53 billion in 2025, and is projected to reach around US$ 213.36 billion by 2034. The market is expanding at a CAGR of 3.65% between 2025 and 2034.

The global cardiovascular devices market size is calculated at US$ 78.13 in 2024, grew to US$ 83.79 billion in 2025, and is projected to reach around US$ 156.33 billion by 2034. The market is expanding at a CAGR of 7.24% between 2025 and 2034.

The global cardiac safety services market size reached USD 824.35 million in 2024, grew to USD 919.57 million in 2025, and is projected to hit around USD 2459.29 million by 2034, expanding at a CAGR of 11.55% during the forecast period from 2025 to 2034.

The global AI in cardiology market size is expected to increase from USD 2.56 billion in 2025 to USD 36.64 billion by 2034, growing at a CAGR of 34.38% throughout the forecast period from 2025 to 2034, as a result of the rising prevalence of cardiovascular disorders and improve technological advancements.

The U.S. cardiac ablation market size is calculated at US$ 1.92 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 7.2 billion by 2034. The market is expanding at a CAGR of 14.19% between 2025 and 2034.

Segments Covered in the Report

By Product

- Web/ cloud-based HER

- On-premise EHR

By Business Model

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others (Support & Maintenance, Managed Services, etc.)

By End Use

- Hospital

- Ambulatory Surgical Centers

- Other end use

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Invest in this premium research report for smarter decisions | Buy Now @ https://www.towardshealthcare.com/checkout/6490

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/ecg-less-cardiac-imaging-market-sizing

https://www.towardshealthcare.com/insights/atrial-fibrillation-treatment-market-sizing

https://www.towardshealthcare.com/insights/drug-eluting-balloon-catheters-market-sizing

https://www.towardshealthcare.com/insights/mental-health-ehr-software-market-sizing

https://www.towardshealthcare.com/insights/electronic-health-records-market-size

https://www.towardshealthcare.com/insights/clinical-decision-support-systems-cdss-market-sizing

https://www.towardshealthcare.com/insights/heart-rate-monitor-market-sizing

https://www.towardshealthcare.com/insights/heartworm-treatment-products-market-sizing

https://www.towardshealthcare.com/insights/congenital-heart-defect-devices-market-sizing

https://www.towardshealthcare.com/insights/bioresorbable-coronary-stents-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.